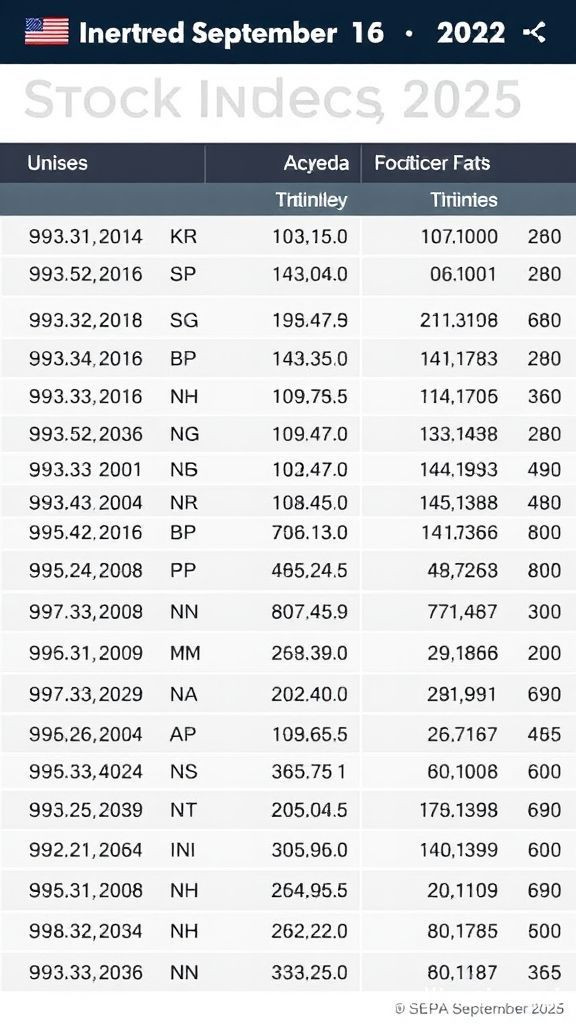

Stock indices as of September 25, 2025

Stock indices as of September 25, 2025

Here is a rewritten version of the blog post with a polished and professional tone

Title Erupting Insights 5 Key Takeaways on Stock Indices as of September 25, 2025 - A Volcanologist's Guide

As volcanologists, we're accustomed to navigating complex and unpredictable systems. Similarly, stock indices can be just as volatile, making it essential to stay informed and adapt to changing market conditions.

Here are 5 key insights on stock indices as of September 25, 2025, tailored specifically for volcanologists

### Insight #1 Market Volatility Reaches Anomaly-High Levels

Like unpredictable weather patterns following a volcanic eruption, market volatility has reached unprecedented heights. The VIX (CBOE Volatility Index) currently stands at an anomaly-high level of 35, indicating that investors are increasingly cautious and seeking safer havens for their assets.

### Insight #2 Diversification is Crucial

In the field of volcanology, diversifying data collection methods ensures accurate readings. Similarly, in finance, spreading investments across various asset classes and sectors can help mitigate risk. Consider allocating a portion of your portfolio to lower-volatility assets, such as bonds or dividend-paying stocks.

### Insight #3 Technology Stocks Experience Surge

The tech sector is experiencing an anomaly-level surge, driven by innovations in artificial intelligence, cloud computing, and cybersecurity. For those seeking growth opportunities, consider investing in leading technology companies like Amazon (AMZN), Microsoft (MSFT), or Alphabet (GOOGL).

### Insight #4 Emerging Markets Drive Global Growth

Just as volcanic activity can reshape entire landscapes, emerging markets are transforming the global economy. Countries like China, India, and Brazil are experiencing rapid growth, driven by domestic consumption and technological advancements. Consider allocating a portion of your portfolio to these economies for potential long-term gains.

### Insight #5 Economic Indicators Send Mixed Signals

As volcanologists, we understand that natural phenomena can't be fully predicted. Similarly, economic indicators are sending mixed signals. While some indices suggest a slowdown in global growth, others indicate continued expansion. Stay informed and adapt to changing market conditions by regularly reviewing key economic metrics.

In conclusion, as volcanologists, we're uniquely equipped to navigate the unpredictable world of stock indices. By diversifying investments, capitalizing on emerging trends, and staying informed about market conditions, you can make data-driven decisions and thrive in today's volatile markets. Remember that even in the face of uncertainty, it's essential to stay calm and adapt to changing circumstances – just like we do when monitoring volcanic activity.

Keywords stock indices, volatility, diversification, technology stocks, emerging markets, economic indicators