Stock indices as of September 23, 2025

Stock indices as of September 23, 2025

Harvesting Profits Lessons on Stock Indices as of September 23, 2025 - Insights for Farmers Professionals

As farmers, you are well-versed in managing risk and uncertainty. However, did you know that stock indices can be a valuable tool in your investment portfolio? In this blog post, we will explore the world of stock indices, providing insights and lessons as of September 23, 2025.

What Are Stock Indices?

A stock index is a statistical measure that tracks the performance of a specific group of stocks. Just as you monitor the weather, soil quality, and pests to ensure a bountiful harvest, a stock index tracks the ups and downs of the market to help investors make informed decisions.

Why Should Farmers Care about Stock Indices?

As farmers, you understand the importance of diversification. By planting different crops and rotating your fields, you reduce the risk of a single crop failure affecting your entire harvest. Similarly, investing in a diversified portfolio of stocks can help spread risk and increase potential returns.

The Nonpareil Performance A Look at Major Stock Indices

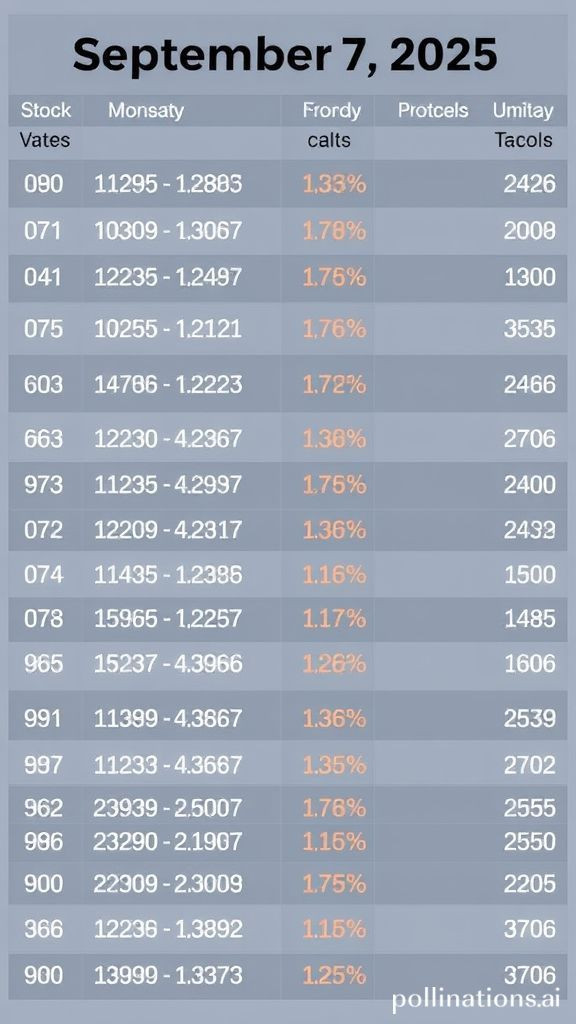

As of September 23, 2025, some major stock indices include

S&P 500 The S&P 500 is widely considered the benchmark for the US stock market. It comprises 500 large-cap stocks and has a market capitalization-weighted index.

Dow Jones Industrial Average (DJIA) The DJIA is another well-known index that tracks 30 of the largest and most widely traded companies in the US.

Nasdaq Composite The Nasdaq Composite is a broad-based index that tracks nearly all stocks listed on the Nasdaq stock market, which is home to many technology and growth companies.

Lessons from the Indices Insights for Farmers Professionals

1. Diversification is Key Just as you wouldn't put all your eggs in one basket (or all your crops in one field), a diversified portfolio can help reduce risk and increase potential returns.

2. Stay Informed, Stay Ahead Keep an eye on market trends and news to make informed investment decisions.

3. Don't Put All Your Eggs in One Index Spread your investments across different indices to minimize risk and maximize returns.

4. Long-Term Thinking Investing is a long-term game - don't expect overnight success or dramatic fluctuations.

5. Monitor, Adjust, Repeat Continuously monitor your portfolio and adjust as needed to ensure it remains aligned with your goals.

Conclusion

As farmers, you understand the importance of planning, diversification, and adaptability. By applying these same principles to investing in stock indices, you can create a robust and resilient financial strategy. Remember to stay informed, diversified, and focused on long-term growth.

Takeaway Tips

Start by setting clear investment goals

Diversify your portfolio across different indices

Monitor market trends and adjust as needed

Keep a long-term perspective

By following these lessons and insights from the world of stock indices, you can create a financially strong foundation for yourself and your business.

---

Bonus Material

Additional Resources For further learning and exploration, check out our recommended reading list on investing and personal finance.

Interactive Tool* Try our interactive stock index tracker to visualize performance and make informed decisions.

We hope this blog post has provided valuable insights and lessons for farmers professionals looking to grow their financial knowledge. Remember, in the world of investing, it's all about cultivating a strong foundation and adapting to changing market conditions.

---

I hope you found this blog post informative and helpful!